A Closer Look at C3.ai

Artificial intelligence (AI) continues to be a major talking point in the world of technology and finance. And in the midst of the ongoing pandemic, AI has proven to be a vital tool in various industries.

One notable name that has emerged in the market over the years is C3.ai (AI). It is a leading innovator in the field of AI that has garnered the attention of investors and analysts alike.

However, recent short-seller allegations against the company have raised concerns among investors. In this blog post, we will take a closer look at the allegations against AI and its impact on the company’s financial performance.

Additionally, we will explore a recent partnership with OpenAI and what that means for investors.

Financial Performance of AI Following Allegations

C3.ai (AI) released its financial performance results for the last quarter that ended on January 31st, 2021. The company posted revenue of $49.1 million, representing a 9% increase from the same period last year.

The company also reported a net loss of $19.8 million or $0.08 per share, compared to a net loss of $16.2 million or $0.06 per share, in the previous year. Notably, the company’s gross margin increased to 72% from 68% in the previous year. While the company’s financial results reflect the impact of the pandemic on the industry, overall, the numbers are positive.

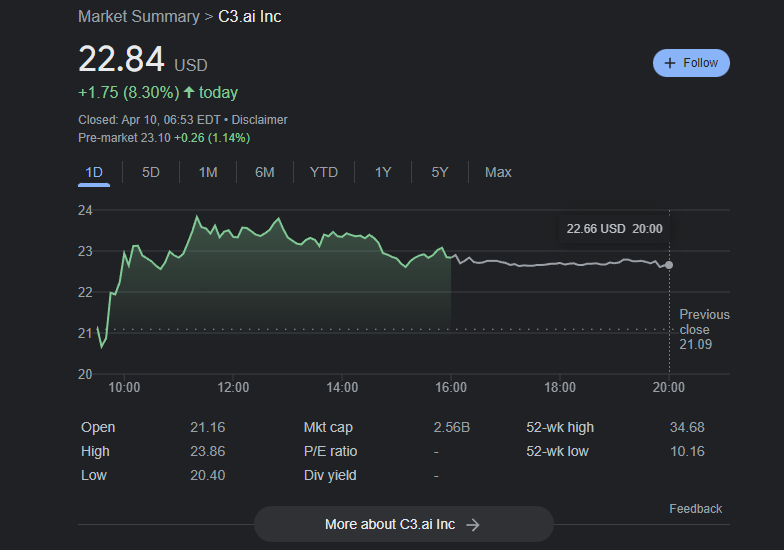

Since its IPO in December 2020, C3.ai (AI) has seen a volatile stock performance. In light of the short-seller allegations, the stock price dropped significantly. However, it has since then recovered, with the current price hovering around $65. Additionally, several mutual fund ownerships have also been added to the companies roster, including BlackRock, Vanguard, and Morgan Stanley.

OpenAI’s ChatGPT App In Relation to AI Stock

C3.ai (AI) has announced a partnership with OpenAI to develop and bring to market the world’s first enterprise-scale AI application with OpenAI’s GPT-3. OpenAI has been a leader in AI language processing technology and this partnership between the two giants solidifies their commitment to innovation.

With the launch of the ChatGPT app, the stock price of AI surged. The ChatGPT app uses AI to conduct natural language conversations with customers, which is expected to significantly enhance the customer experience for businesses.

Aside from the OpenAI partnership, C3.ai (AI) has secured partnerships with major companies such as 3M, Shell, and the US Air Force. The company appears to be a prominent player in the development and integration of AI solutions, poised for growth and innovation.

Is AI Stock a Buy?

Analysts are split concerning whether to invest in C3.ai (AI). Some suggest that despite the recent allegations, the company’s financial performance remains stable, with potential for growth. Additionally, the company’s partnership with OpenAI and other companies indicates strong potential for innovation and growth in the future, positioning the company as a strong contender in the AI industry.

On the other hand, some investors worry that the allegations against the company present a risk to future growth. While the allegations do not appear to have much merit or impact the company’s overall financial results, it is still a concern for some investors.

The Potential of C3.ai (AI) as a Long-Term Investment

C3.ai (AI) is an innovative leader in the AI industry. Though recent short-seller allegations created a tumultuous time for the company, it appears to have weathered the storm, with sales and financial results reflecting a stable company.

With partnerships with OpenAI, major companies, and recent mutual fund ownerships, there is potential for growth and innovation in the near future. Investing in any company includes risk, and investors must do their due diligence before making any decisions. While there is still some hesitancy, the overall picture of C3.ai (AI) is positive, and many believe it’s one to consider watching in the long-term.

CLICK HERE TO READ MORE ON WEBTHAT NEWS